Depreciation of building formula

The depreciation rate can also be calculated as the reciprocal of the useful life Useful Life Useful life is the estimated time period for which the asset is expected to be functional and can be. To increase cash flows and to further increase the value of a business tax shields are used.

The Cost Approach Reproduction Replacement Cost Reproduction Or Depreciation On Site Property Reproduction Building Costs Heating Cooling System Approach

The unit depreciation expense would be calculated as follows.

. Next determine the depreciation rate category based on the propertys natureIt would be either 5 10 or 100 which would be used to calculate the annual depreciation of the building. Property depreciation 101. Depreciation is expensing the cost of an asset that produces revenue during its.

The EBITDA metric is a variation of operating income EBIT that excludes certain non-cash expenses. The formula for straight-line depreciation is. The effect of a tax shield can be determined using a formula.

Depreciation Formula Table of Contents Formula. The term depreciation refers to the notional amount by which the value of a fixed asset such as building plant machinery equipment etc is reduced over its entire life span until it reaches zero or its residual or salvage value. Since depreciation is a non-cash expense and tax is a cash expense there is a real-time value of money saving.

How Accumulated Depreciation Works Accumulated depreciation is a direct result of the accounting concept of depreciation. Unit depreciation expense fair value - residual value useful life in units. Depreciation allows businesses of any kind that purchase equipment or infrastructure such as a building or warehouse to spread out the loss of value of the life of the asset rather than having to take the cost as an expense all at once for tax purposes.

What is EBITDA. When a company acquires an asset that asset may have a long useful life. As per the IRS depreciation can be understood as recovering the cost spent to acquire an asset until it is recovered.

This method uses the following formula. You can use the straight-line depreciation method and divide the total cost by the number of months representing its useful life 420 months to obtain the monthly depreciation expense. Real Estate Depreciation is a crucial tax-saving tool.

Accumulated depreciation is the cumulative depreciation of an asset up to a single point in its life. Whether it is a company vehicle goodwill corporate headquarters or a. The Balance Building Your Business.

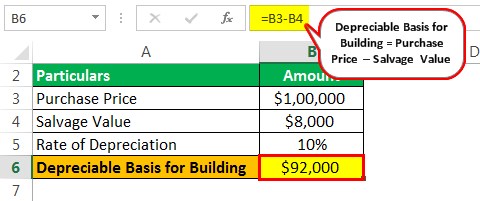

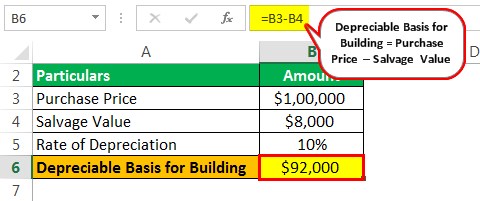

Purchase cost- salvage valueuseful life. This is usually the deduction multiplied by the tax rate. On the income statement it represents non-cash expense but it reduces net income too.

Relevance and Uses of Depreciation Expenses Formula. What is the Depreciation Formula. Depreciation Expense is very useful in finding the use of assets each accounting period to stakeholders.

EBITDA stands for Earnings Before Interest Taxes Depreciation and Amortization and is a metric used to evaluate a companys operating performanceIt can be seen as a loose proxy for cash flow from the entire companys operations. Australian law allows investors to claim tax deductions on both the decline in value of the buildings structure and items considered permanently fixed to the property and the decline in value of plant and. The mechanism involves an asset such as a building which is depreciated every year.

If a company has a piece of machinery worth 150000 with a residual value of 10000 and produces 70000 units. 150000 - 10000 70000 2. Tax benefits also take place in depreciation.

Lower net income results in lower tax liability too. An assets carrying value on the balance sheet is the difference between its purchase price. What is the straight line depreciation formula.

The company should record depreciation of 30000 every year for the next five years. As an example a company buys a new machine for 165000 in 2011. How to Calculate Building Depreciation.

Depreciation cost - salvage value. Using the formula for accumulated depreciation the calculation for year 2 with the values filled in is. The straight-line depreciation formula is.

Nine tips to help you claim the depreciation of your investment property against your taxable income. And the estimated useful life of the building is 35 years. The salvage value is 15000 and the machines useful life is five years.

Depreciation Schedule Formula And Calculator

Ebitda Vs Net Income Infographics Here Are The Top 4 Differences Between Net Income Vs Ebitda Net Income Learn Accounting Accounting And Finance

How To Calculate Depreciation Youtube

Depreciation Of Building Definition Examples How To Calculate

Depreciation Schedule Formula And Calculator

Business Valuation Veristrat Infographic Business Valuation Business Infographic

Depreciation Methods Principlesofaccounting Com

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Depreciation Schedule Formula And Calculator

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Math Pictures Credit Education

How To Calculate Depreciation Expense

Depreciation Of Building Definition Examples How To Calculate

Straight Line Depreciation Accountingcoach

Depreciation Of Building Definition Examples How To Calculate

Depreciation Schedule Template Depreciation Schedule Irs Depreciation Schedule Excel Template Dep Schedule Template Marketing Plan Template Schedule Templates

Depreciation Formula Calculate Depreciation Expense

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping